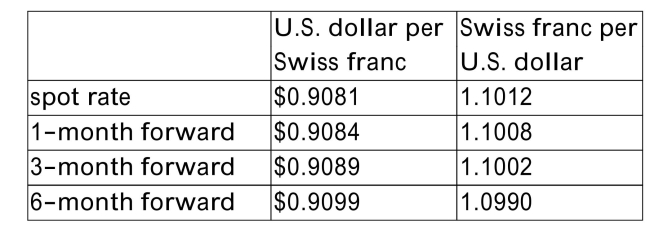

Your U.S. firm will need to make a payment of 200,000 Swiss francs in 6 months and

would like to hedge its exchange rate risk. The following data has been collected on

the Swiss franc/U.S. $ exchange rates:  Explain what your firm should do to hedge the risk completely. Be specific. What will

Explain what your firm should do to hedge the risk completely. Be specific. What will

be the dollar cash outflow to your firm in 6 months if it executes this hedge? What

would it be if the actual future spot rate were 1.0890 Swiss francs/$ in 6 months, and

your firm had not executed this hedge?

Definitions:

Current Performance

Refers to the present level of effectiveness and efficiency with which tasks and objectives are being met.

Middle Managers

Managers who oversee the work of junior managers and report to higher-level executives, acting as a link between the executive level and the operational staff.

Top Managers

Individuals holding senior positions within an organization, responsible for making strategic decisions and guiding the organization towards its goals.

Full Commitment

A state of being fully dedicated and loyal to a cause, activity, or goal, showing no doubt or hesitation in one's support or involvement.

Q4: Refer to the information above. Calculate the

Q9: What is the difference between a market

Q18: Firms tend to retire debt when<br>A)their stock

Q30: Which of the following is not a

Q30: Another name for the hedge ratio is

Q33: Your parents have informed you that they

Q36: Which of the following is a conclusion

Q38: Which of the following estimation errors would

Q54: Which of the following statements about coercive

Q58: A project that costs $12,000 today is