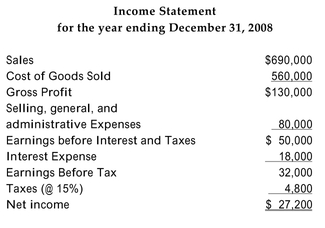

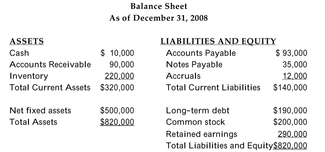

The 2008 financial statements for Carmela's Catering are as follows:

The firm has 100,000 shares of common stock outstanding with a market value of $8 a share.

The firm has 100,000 shares of common stock outstanding with a market value of $8 a share.

-Refer to the information above. The cost of Carmela's debt capital is 8%. The market beta of the firm's equity is 1.4. The relevant risk-free rate is 4% and the expected return on the market

Portfolio is 10%. Calculate Carmela's weighted average cost of capital.

Definitions:

Foot-In-The-Door Technique

A persuasion strategy where a small request is made first, with the aim of getting compliance for a larger request later.

Social Manipulation Technique

Strategies or methods used to influence or control others' behaviors, attitudes, or perceptions in social contexts.

Personality Characteristics

Traits that define an individual's patterns of thought, feeling, and behavior.

Size Of The Group

refers to the number of individuals included within a defined group or collective, which can influence group dynamics and interactions.

Q8: Which of the following business ventures should

Q17: How long will it take for a

Q20: The spot exchange rate today is $1.4714

Q25: What does the "terminal value" represent?

Q34: Which of the following balance sheet accounts

Q36: Which of the following statements is true?<br>A)Empirical

Q36: The Thunderstruck Corporation paid $130,000 for an

Q42: You would like to establish a fund

Q59: Refer to the information above. What is

Q60: According to Modigliani and Miller, in a