There are 1 million shares outstanding with a current market value of $2 a share.

There are 1 million shares outstanding with a current market value of $2 a share.

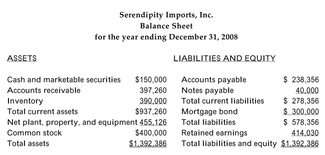

-Refer to the information above. Calculate the following ratios for Serendipity Imports:

Total liabilities-to-assets, based on book value, financial debt-to-capital, based on

book value, financial debt-to-capital, based on market value, and the interest coverage

ratio.

Definitions:

Profit Maximization

This strategy entails making business decisions that increase a firm's profits to its highest potential by evaluating cost structures and price points.

Price Elasticity Of Demand

A measure of how much the quantity demanded of a good responds to a change in its price, indicating its sensitivity.

Marginal Cost

The additional cost incurred from producing one more unit of a good or service.

Profit-Maximizing Seller

An economic agent whose primary objective is to achieve the highest possible profit from their sales.

Q5: The last date on which an investor

Q5: The corporate scandals (e.g., Enron)of 2001-2003 were

Q9: Refer to the information above. What is

Q9: A firm has a market value of

Q16: Which of the following statements regarding real

Q19: A call option<br>A)gives the owner of the

Q23: Calculate the Macaulay duration of a $1,000,

Q35: Refer to the information above. Assume the

Q36: Trade credit is<br>A)a type of bank loan.<br>B)an

Q44: If you accumulate $800,000 in your retirement