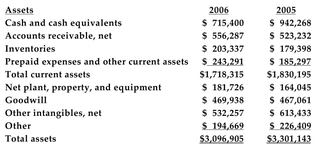

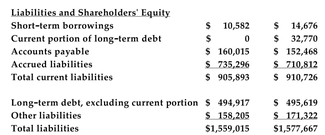

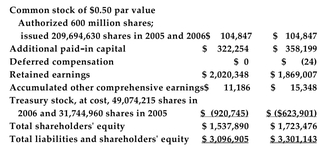

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars) :

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

-Refer to the information above. Which of the following statements regarding changes in Hasbro's capital structure from 2005 to 2006 is true?

Definitions:

Flow-Through Entities

Business entities that pass their income, deductions, and credits down to their owners for tax purposes, avoiding taxation at the corporate level.

LLC's

Stands for Limited Liability Companies, a business structure in the U.S. that offers personal liability protection to its owners but can be taxed as a partnership.

S Corporations

A special designation of corporation that allows income to be taxed only at the shareholder level, avoiding double taxation.

Flow-Through Entities

Entities through which income flows to the owners or investors, avoiding corporate income tax.

Q9: A firm has a market value of

Q9: If the real rate of return is

Q20: The rate of return that your investors

Q23: Preetham is considering an investment that has

Q26: A local television station sends out questionnaires

Q32: Aspen Valley Storage has 1,800 units. Each

Q33: A vineyard produces two special wines a

Q44: Refer to the information above. Assume the

Q51: Which of the following statements is true?<br>A)Large

Q62: Which of the following is a correct