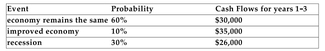

Project A is a 3-year project that will cost $50,000 today. You have estimated the following probability distribution for the future cash flows from the project:

-Refer to the information above. Project A's most likely future annual cash flow is

Definitions:

Current Cost Accounting

An accounting approach that records assets and liabilities at their current market value rather than their historical cost.

Realized Gains

Profits made from the sale of assets that exceed the purchase price, distinguishing from unrealized gains on assets still held.

LIFO Inventory

Last-In, First-Out, an inventory valuation method that assumes the last items added to inventory are the first sold, affecting the reported income and inventory value.

FIFO Inventory

FIFO Inventory, or First-In, First-Out, is an inventory valuation method where the goods first purchased or produced are the first to be sold.

Q5: According to the study by Frank de

Q33: A vineyard produces two special wines a

Q37: A firm has 1 million shares outstanding

Q45: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" A) (-2, 3)

Q51: Which of the following are non-financial claims?<br>A)pension

Q57: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" A) (3, 2)

Q57: An "on-the-run" Treasury security<br>A)will command a higher

Q59: A factory currently produces output that sells

Q65: An investment earned 12% in one year.

Q81: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" A) x1 =