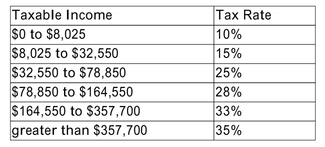

In 2008, the tax schedule for a single taxpayer is as follows:  What is the marginal tax rate and the average tax rate of a single taxpayer who has taxable income of $60,000?

What is the marginal tax rate and the average tax rate of a single taxpayer who has taxable income of $60,000?

Definitions:

Residual Value

Residual value refers to the predicted value of an asset at the conclusion of its lifespan.

Estimated Life

The expected period during which an asset is considered to be useful in operations, affecting depreciation calculations.

Capital Expenditure

Resources deployed by a business to buy, enhance, and manage material assets, including real estate, manufacturing facilities, or devices.

Debit

Amount entered on the left side of an account.

Q8: The law of one price stipulates that<br>A)the

Q16: Which of the following statements is true?<br>A)A

Q16: Assume risk-neutrality and that the appropriate interest

Q31: How are the various market imperfections reflected

Q33: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" " class="answers-bank-image d-inline" rel="preload"

Q49: The following message was encoded with matrix

Q59: When using the adjusted present value (APV)valuation

Q59: The input-output matrix for an economy is

Q77: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" " class="answers-bank-image d-inline" rel="preload"

Q80: If you pay $5,500 for a simple