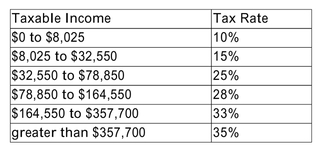

In 2008, the tax schedule for a single taxpayer is as follows:  The tax rate for capital gains and dividend income is 15% for investors in marginal tax brackets greater than 15%. Paul invested $10,000 in the stock market and $10,000 in bonds. During the

The tax rate for capital gains and dividend income is 15% for investors in marginal tax brackets greater than 15%. Paul invested $10,000 in the stock market and $10,000 in bonds. During the

Year Paul earned $1,000 in dividends and $900 in interest income from these investments. If

Paul is in the 28% marginal tax bracket, what was his tax obligation on the income from his

Portfolio?

Definitions:

Networking

The act of building and maintaining professional or social connections to exchange information, resources, and opportunities.

Ethical Principles

Fundamental guidelines or rules that govern ethical behavior and decision-making.

Decision Making

The process of selecting among several alternatives to achieve a desired outcome or solve a problem.

Organizational Rewards

The benefits, both tangible and intangible, that an organization offers to its members for their contributions.

Q7: David owns the building out of which

Q19: A good manager should set the hurdle

Q45: All else equal, which of the following

Q53: In a group of 42 students, 22

Q58: True, False, or Uncertain: "When the expected

Q68: Jennifer invested $6000 in her savings account

Q95: There were 35,000 people at a ball

Q108: A company that manufactures laser printers for

Q122: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" A) function B)

Q181: xy + 3y = 5<br>A) A function