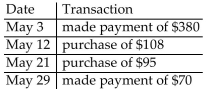

Use the average daily balance method to compute the amount of interest that will be charged at the end of the billing

cycle. Use a 365-day year.

-Month: May (31 days) Previous month's balance: $960

Interest rate: 19%

Definitions:

Empirical Analysis

The use of observed and measured phenomena to investigate relationships and test theories.

Sociology

The study of human behavior in society.

Conflict Theory

A theoretical perspective that emphasizes the role of power and coercion in producing social order.

Social Change

The alteration of social interaction, social institutions, stratification systems, and elements of culture over time.

Q1: Interest is the borrower's payment to the

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" A)

Q11: Find the 67th term of the sequence

Q13: The IQ Corporation has two divisions. Division

Q33: Which of the following is a tool

Q36: $600 at 8% compounded quarterly for 5

Q51: Let U = {a, l, i, t,

Q54: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" A) 14 B)

Q58: The _ investment must be shown as

Q60: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8591/.jpg" alt=" A) Not Reduced