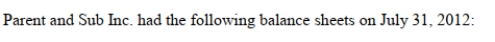

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 100% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assume that Parent Inc. purchased a controlling interest in Sub Inc. on August 1, 2012 and decides to prepare an Income Statement for the combined entity on the date of acquisition. If Parent acquired 100% of Sub Inc. on that date, what would be the net income reported for the combined entity (for the year ended July 31, 2012) ?

Definitions:

State Court

The judiciary body at the state level in the United States, handling legal disputes and interpreting state laws.

Not Guilty

A legal verdict indicating that there is not enough evidence to prove beyond a reasonable doubt that the individual committed the crime they were charged with.

Criminal Case

A legal proceeding against an individual or organization accused of violating laws that protect the public's moral or physical welfare, resulting in penalties like imprisonment or fines.

Amicus Curiae

A "friend of the court" who, although not a party to the litigation, offers information or expertise relevant to the case to assist the court in its deliberation.

Q9: Big Guy Inc. purchased 80% of the

Q9: LEO Inc. acquired a 60% interest in

Q12: Which of the following statements is FALSE?<br>A)

Q16: Which of the following employees at Fresh

Q24: If a not-for-profit organization uses the restricted

Q33: Why might the fair value of the

Q34: X Inc. and Y Inc. are virtually

Q58: The value chain is a key component

Q60: John Inc and Victor Inc for its

Q76: In most situations, managerial accounting reports solve