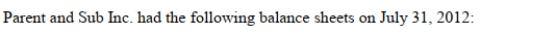

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc. purchased 80% of Sub's voting shares on the date of acquisition (August 1, 2012) for $180,000, what would be the amount of the Non-Controlling Interest on the date of acquisition if the Entity Method were used?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming that Parent Inc. purchased 80% of Sub's voting shares on the date of acquisition (August 1, 2012) for $180,000, what would be the amount of the Non-Controlling Interest on the date of acquisition if the Entity Method were used?

Definitions:

Work in Process Inventory

Items of inventory that are in the process of being produced but are not yet finished goods.

Work in Process Inventory

Goods in manufacturing that are partially completed, situated between raw materials and finished products.

Direct Material Cost

The cost of raw materials that can be directly attributed to the goods being produced.

Predetermined Overhead Rate

A rate used in costing to allocate indirect costs to products or services based on a predetermined formula.

Q6: The July utility bills (in dollars)

Q17: When a contingent consideration arising from a

Q23: Under which method of accounting for investments

Q24: Marshall Welding uses the step-down method of

Q25: Compound interest is interest earned not only

Q30: Income-smoothing has been applied to a German

Q37: John Inc and Victor Inc for its

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q56: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) A liability

Q57: Using the step-down method and assuming that