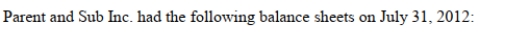

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming the Entity Theory was applied, what would be the amount of Goodwill appearing on the Consolidated Balance Sheet on the Date of acquisition, assuming once again that Parent purchased 80% of Sub Inc. for $180,000?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming the Entity Theory was applied, what would be the amount of Goodwill appearing on the Consolidated Balance Sheet on the Date of acquisition, assuming once again that Parent purchased 80% of Sub Inc. for $180,000?

Definitions:

Contract Price

The total monetary amount agreed upon by the parties involved in a contract for the exchange of goods, services, or property.

Installment Sale

A financial arrangement allowing the buyer to make payments over a specified period of time, often used in real estate transactions.

Personal Residence

A property where the taxpayer lives for the majority of the tax year, often qualifying for tax benefits like the mortgage interest deduction.

Selling Expenses

Costs incurred directly in the selling or distribution of goods or services, such as advertising, promotional materials, and sales staff salaries.

Q4: The National Association of Realtors estimates that

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) If an

Q12: Find the area under the standard

Q18: Internal controls focus on all of the

Q22: John has six bills of paper money

Q28: Quatro Corporation manufactures two chemicals (Flextra and

Q33: The consolidation elimination entry required to remove

Q37: After the introduction of the entity method

Q38: A marketing research company needs to

Q64: A computer package was used to