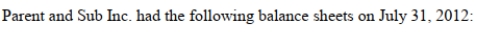

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. If Parent Company purchased 80% of Sub Inc. for $180,000, the Liabilities section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under GAAP after January 1, 2011?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. If Parent Company purchased 80% of Sub Inc. for $180,000, the Liabilities section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under GAAP after January 1, 2011?

Definitions:

Competency-Based Pay

A salary system that bases compensation on an employee's skills, abilities, and performance rather than job title or position alone.

Commission Pay

A form of compensation based on a percentage of sales or profits generated by an employee, commonly used in sales roles to motivate performance.

Profit Sharing

Any procedure by which an employer pays, or makes available to all regular employees, in addition to base pay, special current or deferred sums based on the profits of the enterprise

Job Classification System

A system of job evaluation in which jobs are classified and grouped according to a series of predetermined wage grades.

Q11: RXN's year-end is on December 31. On

Q19: Which of the following would be considered

Q28: Find the critical values, <span

Q42: When the Non-Controlling Interest's share of the

Q44: The amount of money collected by a

Q47: Parent and Sub Inc. had the following

Q49: All of the following entities would have

Q56: Find the area under the standard

Q59: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Prepare

Q93: True or False: As the number of