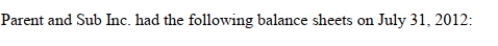

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming Parent purchased 80% of Sub Inc. for $180,000; the Assets section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under the Entity Method?

The Net Incomes for Parent and Sub Inc for the year ended July 31, 2012 were $120,000 and $60,000 respectively. Assuming Parent purchased 80% of Sub Inc. for $180,000; the Assets section of Parent's Consolidated Balance Sheet on the date of acquisition (August 1, 2012) would total what amount under the Entity Method?

Definitions:

Dichotomous Thinking

A cognitive distortion involving seeing things in black and white, or all-or-nothing terms, lacking shades of gray.

Overgeneralization

A cognitive distortion where a person draws broad, generalized conclusions from a single or few incidents, often leading to negative thinking and outcomes.

REBT

Rational Emotive Behavior Therapy, a form of psychotherapy that focuses on identifying and changing irrational beliefs that cause emotional distress.

Irrational Mistake

An error in thinking or belief that is not based on logic or rational judgment.

Q1: Which of the following statements is correct?<br>A)

Q30: Grassley Corporation allocates administrative costs on the

Q31: Company Inc. owns all of the outstanding

Q35: On the date of formation of a

Q36: Which of the following accounting standards have

Q39: On January 1, 2012, Hanson Inc would

Q40: Which of the following would not be

Q54: John Inc and Victor Inc for its

Q71: Find the critical t-value that corresponds

Q73: The Covington Clinic has two service departments