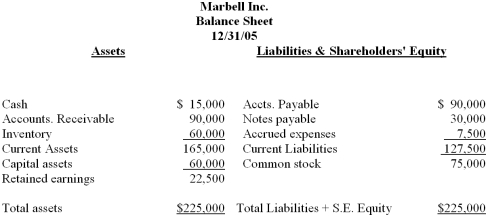

The following is the balance sheet for 2005 for Marbell Inc.  Sales for 2005 were $300,000. Sales for 2006 have been projected to increase by 20%. Assuming that Marbell Inc. is operating below capacity, calculate the amount of new funds required to finance this growth. Marbell has an 8% return on sales and 70% is paid out as dividends.

Sales for 2005 were $300,000. Sales for 2006 have been projected to increase by 20%. Assuming that Marbell Inc. is operating below capacity, calculate the amount of new funds required to finance this growth. Marbell has an 8% return on sales and 70% is paid out as dividends.

Definitions:

Operating Activities

Business activities related to the day-to-day functions of a company involved in producing and delivering its products or services.

Cash Dividends

Payments made by a company to its shareholders out of its profits or reserves.

Balance Sheet

A financial statement that provides a snapshot of a company's financial position at a specific time, detailing assets, liabilities, and equity.

Net Income

The amount of money that remains after all expenses, including taxes and costs of goods sold, have been subtracted from total revenue, indicating the profitability of a company.

Q36: Cash flow is equal to earnings before

Q42: Use of long-term financing and the carrying

Q53: Which of the following is not a

Q55: Shareholders' equity is equal to liabilities plus

Q61: A service provided around the clock by

Q69: Cash break-even analysis eliminates the amortization expense

Q83: The current cost method of inflation-adjusted accounting

Q90: Which of the following is not a

Q95: Free cash flow is equal to cash

Q121: What factors should a financial manager consider