A new restaurant is ready to open for business.It is estimated that the food cost (variable cost)will be 40% of sales,while fixed cost will be $450,000.The first year's sales estimates are $1,250,000.The cost to start up this restaurant will be $2,000,000.Two financing alternatives are being considered: (a)50% equity financing and 50% debt at 12%,or (b)all equity financing.Common stock can be sold at $5 per share.

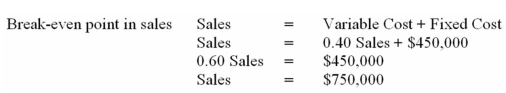

A)Compute break-even point.

B)Compute DOL.

C)Compute DFL and DCL for both financing plans.

D)Include an explanation of what your computations mean.

A)  B) C) D)Subjective.

B) C) D)Subjective.

Definitions:

Net Income

The amount of money remaining after all operating expenses, taxes, and interest have been deducted from total revenue.

Income Distribution

Refers to the manner in which total income is divided among the holders of different types of financial securities and assets.

Hybrid Method

An accounting technique that combines elements of both cash-based and accrual accounting to prepare financial statements.

Partnership

A legal arrangement where two or more individuals or entities engage in business together, sharing profits, losses, and liability.

Q14: Assuming a tax rate of 40%,the after

Q22: BHS Inc.determines that sales will rise from

Q25: A firm has $200,000 in current assets,$400,000

Q27: The term structure of interest rates:<br>A) changes

Q33: After 10 years,1,000 shares of stock originally

Q58: Which of the following combinations of asset

Q64: Operating Leverage is the use of fixed

Q68: What 2 choices does the board of

Q76: The sale of corporate bonds held by

Q134: Accumulated amortization shows up in the income