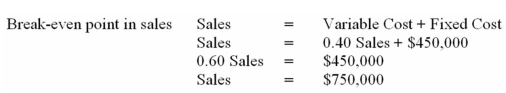

A new restaurant is ready to open for business.It is estimated that the food cost (variable cost)will be 40% of sales,while fixed cost will be $450,000.The first year's sales estimates are $1,250,000.The cost to start up this restaurant will be $2,000,000.Two financing alternatives are being considered: (a)50% equity financing and 50% debt at 12%,or (b)all equity financing.Common stock can be sold at $5 per share.

A)Compute break-even point.

B)Compute DOL.

C)Compute DFL and DCL for both financing plans.

D)Include an explanation of what your computations mean.

A)  B) C) D)Subjective.

B) C) D)Subjective.

Definitions:

Myocardial Infarction

A medical condition, commonly known as a heart attack, resulting from the interruption of blood flow to a part of the heart, causing heart cells to die.

Heart Failure

A medical condition in which the heart is unable to pump blood efficiently throughout the body, leading to symptoms such as fatigue, breathlessness, and fluid retention.

Jugular Vein Pulsations

Observable pulsing of the jugular veins in the neck, which can indicate the heart's function and central venous pressure.

Normal Splitting

A physiological phenomenon where the heart's second sound (S2) separates into two distinct sounds during inhalation due to the delay in closure between the aortic and pulmonary valves.

Q12: Driveline Sprockets expects total sales of $20,000.The

Q25: Yield curves change very little in the

Q30: Profitability ratios allow one to measure the

Q36: Accounting income is based on verifiably completed

Q52: The term "inventory profits" refers to profits

Q64: In developing the pro forma income statement

Q85: What are the characteristics of a sole

Q91: The use of on-line point-of-sale terminals has

Q114: Securitized paper:<br>A) is not part of the

Q121: A lockbox is used by the selling