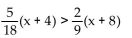

Find the solution set for the inequality.

-

Definitions:

Market Risk Premium

The Market Risk Premium is the additional return an investor expects from holding a risky market portfolio instead of risk-free assets.

Beta

Beta measures the volatility of an investment relative to the market as a whole, indicating how much an investment's price is likely to move in relation to market changes.

Risk-Free Rate

The Risk-Free Rate is the theoretical rate of return on an investment with zero risk, typically represented by the yield on government securities like U.S. Treasury bills.

Market Risk Premium

The additional return expected by investors for taking on the increased risk of investing in the stock market over a risk-free investment.

Q90: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8475/.jpg" alt=" A)

Q116: -2.9<br>A) ><br>B) <

Q130: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8475/.jpg" alt=" A) -7, -8

Q184: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8475/.jpg" alt=" A)

Q189: -2 is an irrational number.

Q204: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8475/.jpg" alt=" A) -4 B)

Q223: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8475/.jpg" alt=" A)

Q228: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8475/.jpg" alt=" A)

Q234: Yvonne decided to drive home from college

Q293: -0.7 _ -0.9<br>A) ><br>B) <