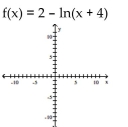

Graph the function using a calculator and point-by-point plotting. Indicate increasing and decreasing intervals.

-

Definitions:

State Income Tax

A tax imposed by a state on the income earned by individuals, corporations, or other legal entities within that state.

Federal Income Tax

The tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities.

Allowances

A revision of the definition referring to sums of money set aside or given for a specific purpose, such as deductions from taxable income to account for certain expenses.

State Income Tax

Taxes levied by individual states on the income earned by residents and, sometimes, non-residents within the state.

Q8: The cost of manufacturing a particular videotape

Q9: log 0.234<br>A) 0.234<br>B) -0.63074<br>C) 1.26364<br>D) -1.45243

Q17: The life expectancy of a car battery

Q35: f(x) satisfies <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8593/.jpg" alt="f(x) satisfies

Q37: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8593/.jpg" alt=" A)

Q59: -----------------------Promissory Note------------------------ March 12<br>Ninety days after date

Q64: Explain the difference between an operating loss

Q68: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8593/.jpg" alt=" A) Unit elasticity

Q82: September 19 to March 6<br>A)168 days<br>B)172 days<br>C)138

Q152: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8593/.jpg" alt=" A) Linear B)