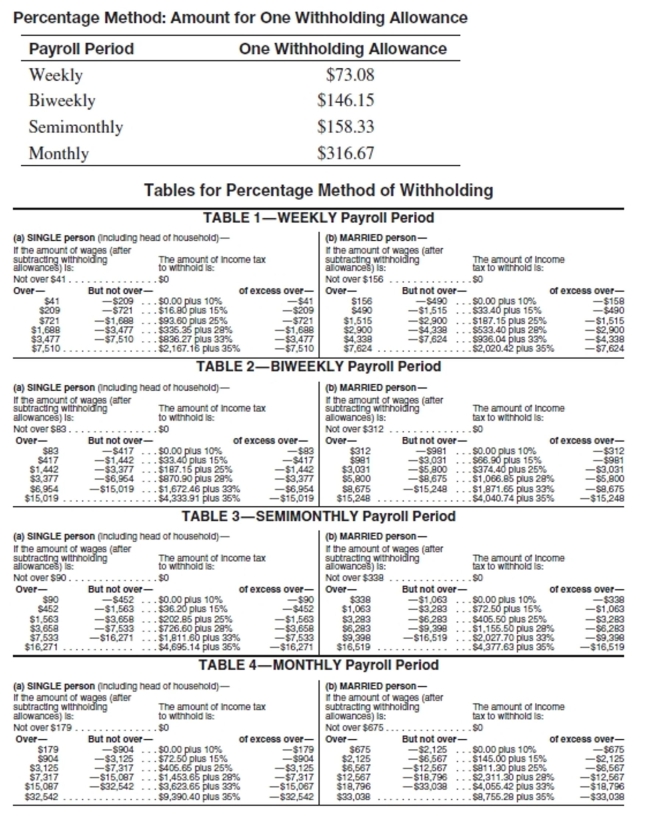

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

-Karen Smith has gross earnings of $7512.15 monthly. She is single and has 6 withholding allowances.

Definitions:

Inefficiencies

The lack of effectiveness or productivity in performing tasks, often leading to wasted resources or time.

Long-Term Disability

Insurance coverage that provides income support to individuals who are unable to work for a lengthy period due to a disabling condition or illness.

Working Income

The earnings received from employment or self-employment, often considered in the context of personal finance and taxation.

Provincial Governments

The administrative bodies governing the provinces of a country, responsible for local laws, policies, and governance within their specific geographical areas.

Q18: A laminated lab bench has <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg"

Q19: Westinghouse Paving pays its salespeople the following

Q24: The Chicago Men's Shop made the following

Q44: 20, 28, 46, 28, 49, 28, 49<br>A)35.4<br>B)49<br>C)28<br>D)46

Q56: Markup on cost: 8.3% Markup on selling

Q70: If 3 times a number is added

Q100: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q101: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)$39.34, $9.20, $6.35

Q115: 135 added to a number<br>A)135x<br>B)135<br>C)135 + x<br>D)135

Q134: Joan can mow a 3-acre field in