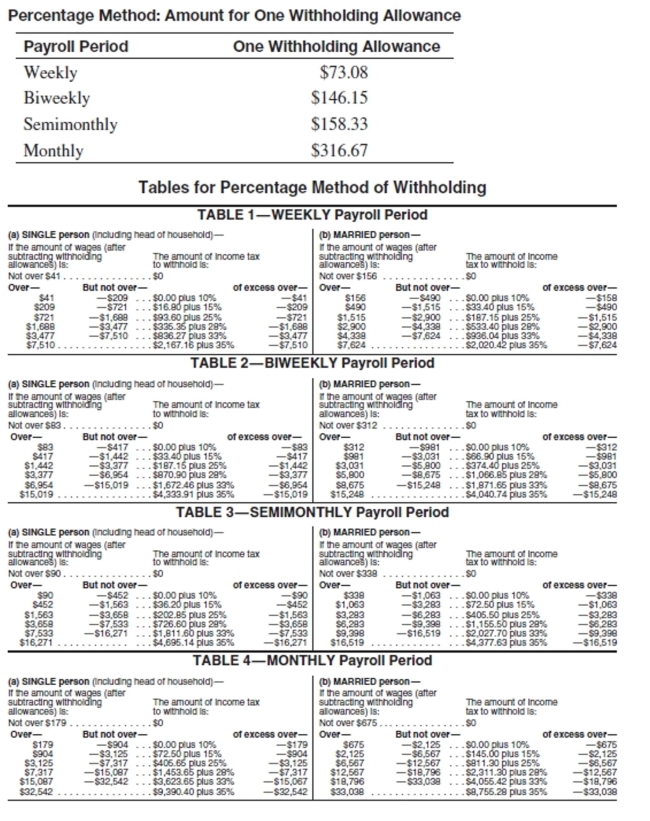

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

-Fred Jones has gross earnings of $4723.08 biweekly. He is married and has 3 withholding allowances.

Definitions:

Preserving

The act of maintaining or keeping something in its original or existing state.

Personal Information

Data relating to an individual that can identify them, such as their name, address, or online identifiers.

Social Security Number

A unique nine-digit number assigned to U.S. citizens and permanent residents, used for tracking individuals for social security and other purposes.

Anniversary

The date on which an event took place in a previous year, often celebrated or commemorated annually.

Q13: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)Cost = $52.29

Q16: A local dealer sells baseballs for $25

Q16: Universal Gallery earned $400 interest in 90

Q33: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8593/.jpg" alt=" A)

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)0.0621 B)6.21 C)0.621

Q68: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q69: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q72: The Book Mart collected $1,485.31 FICA, $347.37

Q83: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q84: John Rosar, framer, earned $34,503.87<br>A)$2,139.24, $500.31<br>B)$4,178.48, $900.61<br>C)$2,139.24,