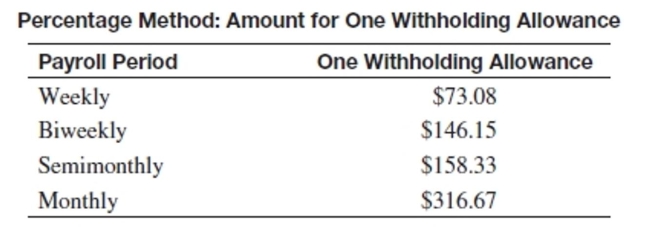

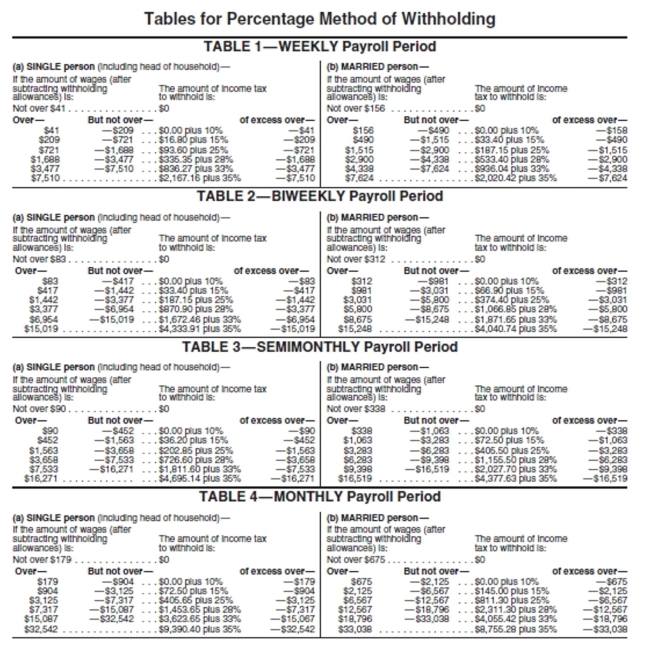

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and

1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over

$115,000 so far this year.

-Thomas McKnight has gross earnings of $22,012.15 monthly. He is married and has 8 withholding allowances.

Definitions:

Down Syndrome

A genetic disorder caused by the presence of an extra chromosome 21, characterized by intellectual disability and physical abnormalities.

Cognitive Deficits

Impairments in mental processing abilities, such as memory, attention, and problem-solving skills.

Analytical Intelligence

One aspect of intelligence involving the ability to analyze, evaluate, judge, compare, and contrast information.

Algorithmic

Pertaining to or involving a finite set of rules that provides a step-by-step process for solving a problem or accomplishing a goal.

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)% Markdown =

Q20: Find the selling price of an item

Q28: Which departments in a grocery store do

Q57: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8593/.jpg" alt=" A)

Q63: The appliance store where the Jordans shop

Q70: Explain why or when the median is

Q74: An invoice is received from Westminster Office

Q99: Explain in your own words the steps

Q106: Face value: $8,207 Discount rate: 12%<br>Date made:

Q107: Tech Support Associates accepts a $5,320, 7%,