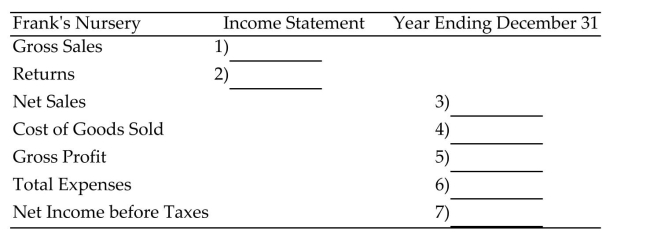

Complete the income statement.

-Frank's Nursery had gross sales of $2,273,000 with returns of $57,800. The inventory on January 1 was $567,000. During the year $1,130,000 worth of goods was purchased with freight of $5,600. The

Inventory on December 31 was $525,000. Wages and salaries were $81,600, rent was $10,200,

Advertising was $17,700, utilities were $5,200, business taxes totaled $8,500, and miscellaneous

Expenses were $6,100.

Definitions:

Q7: High for the year for CompuStrateg (CPS)<br>A)$17.49<br>B)$15.38<br>C)$9.77<br>D)$33.57

Q11: A note is due in 4 years,

Q11: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)11.9%, 75.0%, 11.6%,

Q25: Cost: $9,040<br>Period: 3-year<br>A)$1,339<br>B)$3,013<br>C)$1,808<br>D)$1,736

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)0.676 67.6% B)0.676

Q59: $906 is % of $1,936.<br>A)0.5<br>B)213.7<br>C)46.8<br>D)0.1

Q66: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" " class="answers-bank-image d-inline" rel="preload"

Q91: Explain how you divide a decimal number

Q104: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)13 B)

Q114: A taxpayer's property has a market value