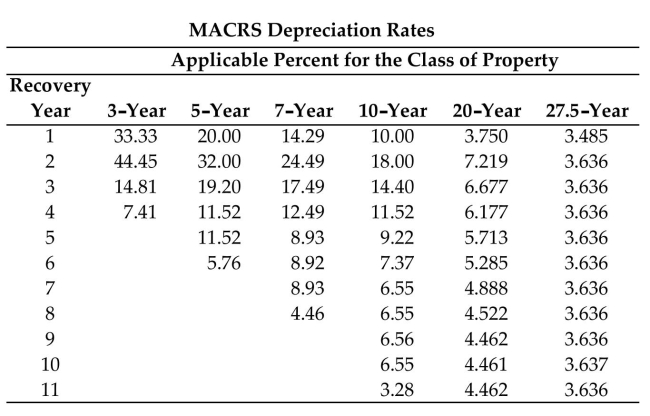

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

-Cost: $309,500

Recovery Period: 7-year

After: First Year

Definitions:

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)36 B)150 C)3

Q26: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)32.0%, 9.0%, 52.6%,

Q44: Juan and Amy Marino had incomes of

Q58: A grocer sold 98 bags of potatoes

Q59: 820 shares of Meredith (MDP) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg"

Q72: 1.596<br>A)0.01596%<br>B)159.6%<br>C)1.596%<br>D)0.1596%

Q75: A taxpayer's property has a fair market

Q84: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" Finance rate is

Q84: 152 rolls is 49% of rolls.<br>A)32<br>B)0.32<br>C)3,102<br>D)310.2

Q97: Part: $8.44 Rate of decrease: 10%<br>A)$8.44<br>B)$7.60<br>C)$109.38<br>D)$9.38