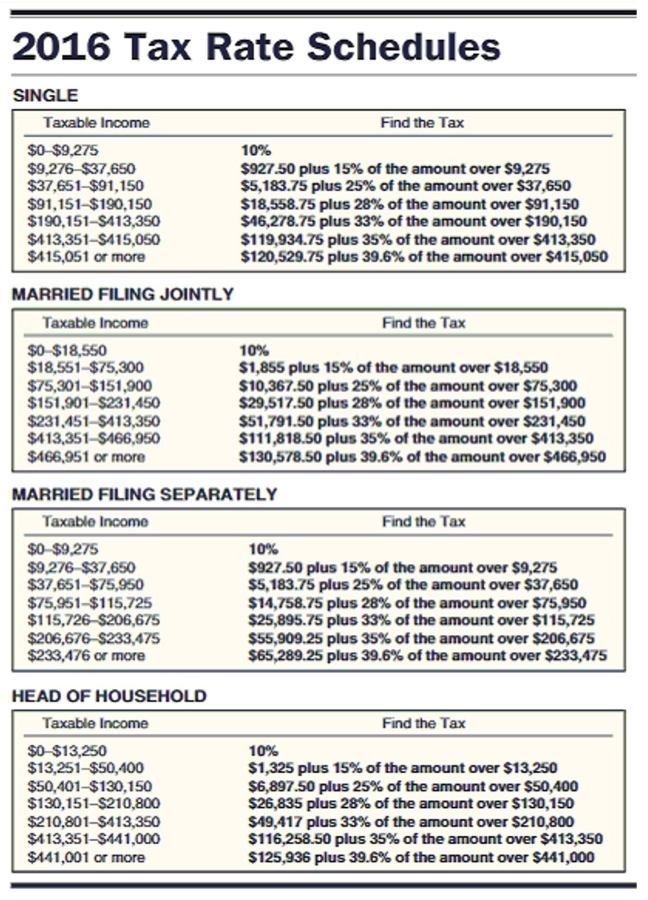

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Mark Collins had an adjusted gross income of $26,741 last year. He had deductions of $899 for state income tax, $555 for property tax, $2,824 in mortgage interest, and $221 in contributions. Collins claims one exemption and files as a single person.

Definitions:

Several Seconds

A very short units of time, typically under a minute, consisting of multiple second increments.

Three-part Model

A conceptual framework divided into three sections or components for analysis or understanding.

Memory Storage

The process of retaining information over time through various forms of brain encoding and organization.

Sensory Storage

The shortest-term element of memory, where sensory information is held just long enough to be processed for basic physical characteristics.

Q4: Cost: $655,000<br>Salvage: $65,500<br>Est. Life: 62,000 hours<br>A)$9.51<br>B)$105.60<br>C)$10.56<br>D)$95.10

Q12: Amount: $2,200<br>Deposited: Jan 27<br>Withdrawn: Apr 5<br>A)$21.30<br>B)$21.94<br>C)$2,214.39<br>D)$14.39

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)1,040 B)252 C)344

Q33: The London Coat Company had an insured

Q33: Southwest Dry Cleaners believes that it will

Q38: Less than 40 years of age<br>A)58<br>B)72<br>C)22<br>D)14

Q59: Cost: $167,000<br>Recovery Period: 7-year<br>After: Fourth year<br>A)$76,954<br>B)$48,096<br>C)$20,858<br>D)$52,171

Q72: 1.596<br>A)0.01596%<br>B)159.6%<br>C)1.596%<br>D)0.1596%

Q79: 10 years of age or older<br>A)7<br>B)11<br>C)93<br>D)82

Q88: $32,000, 8% compounded semiannually, 20 semiannual payments<br>A)$2,280.96<br>B)$2,354.56<br>C)$2,436.44<br>D)$878.89