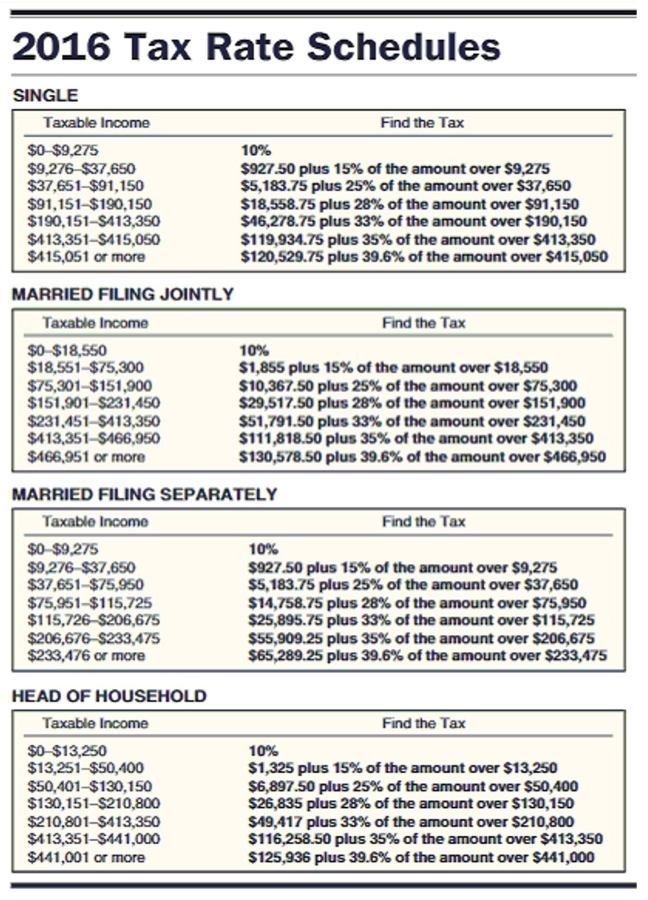

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Glenn and Natalie Dowling had combined wages and salaries of $69,117, other income of $5,258, dividend income of $317, and interest income of $664. They have adjustments to income of $2,435. Their itemized deductions are $9,180 in mortgage interest, $1,611 in state income tax, $846 in real estate taxes, and $1,193 in charitable contributions. The Dowlings filed a joint return and claimed four exemptions.

Definitions:

Passive Artificial Immunity

Immunity acquired by the transfer of antibodies from another individual, as through injection or from mother to fetus across the placenta.

Adaptive Immunity

The branch of the immune system that involves the creation of antibodies and memory cells in response to an exposure to a specific pathogen, providing long-term immunity.

Immediate Protection

Rapid defense mechanisms activated promptly to prevent infection or damage before long-term specific immunity develops.

Natural Killer Cell

A type of lymphocyte in the immune system capable of killing certain infectious organisms and tumor cells without prior immunization.

Q16: The following is the number of hours

Q21: On a 25-point math test student scores

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)71.9%, 77.8%, 92.2%,

Q23: More than 40 years of age<br>A)No answer

Q27: Cost: $400,000<br>Recovery Period: 10-year<br>After: First Year<br>A)$360,000<br>B)$328,000<br>C)$302,040<br>D)$342,840

Q53: List the advantages and disadvantages of using

Q54: 4,700,345<br>A)four million, seven thousand, three hundred forty-five<br>B)four

Q67: Compare the three depreciation methods: straight-line, double-declining-balance,

Q70: $6,400, money earns 8% compounded annually, 10

Q94: 742.32 ÷ 0.061 (Round to the nearest