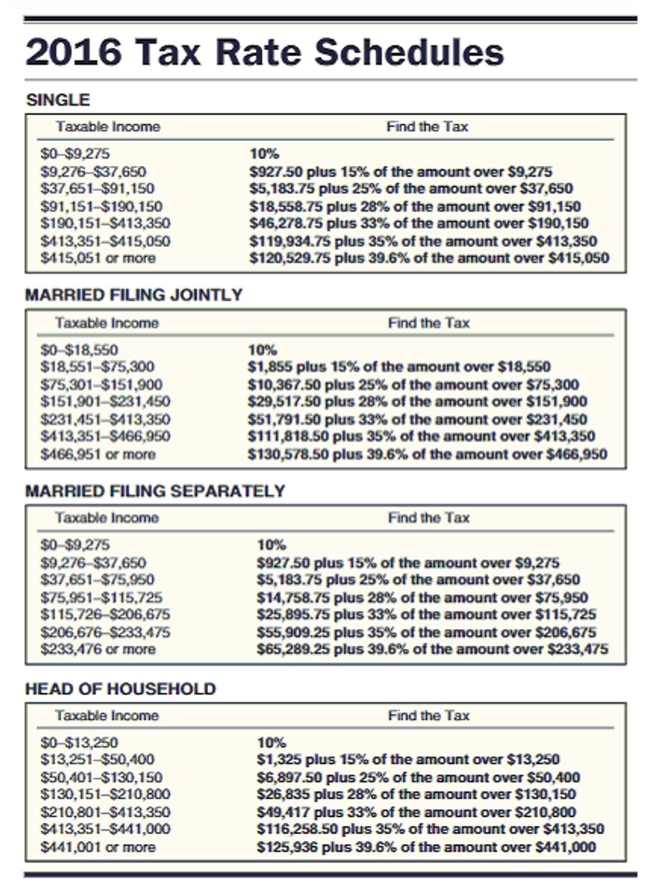

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Brian Moss had wages of $80,745, dividends of $374, interest of $684, and adjustments to income of $1,066 last year. He had deductions of $878 for state income tax, $452 for city income tax, $988 for property tax, $7,336 in mortgage interest, and $182 in contributions. He claims three exemptions and files as head of household.

Definitions:

Net Input Cost

The total expenses incurred in the production process after subtracting any subsidies or other financial incentives.

Economic Well-being

The level of prosperity and quality of economic conditions that individuals or groups experience, often measured by income, employment, and access to resources.

Transfer Payments

Payments made by the government to individuals or other sectors without receiving a good or service in return, such as welfare, social security, and subsidies.

GDP

Gross Domestic Product, the total market value of all final goods and services produced within a country in a given period of time, often used to measure the economic performance of a country.

Q11: Tom Crenna buys a whole life policy

Q13: Current assets: $407,000 Current liabilities: $189,000<br>Liquid assets:

Q55: $56.59200<br>A)$56.60<br>B)$56.59<br>C)$56.589<br>D)$56.58

Q57: The monthly payments on a $68,000 loan

Q67: If rent is represented by 54° on

Q74: Betina Gregory owns municipal bonds valued at

Q74: The five sales people at Southwest Appliances

Q76: During one year 22 new employees started

Q140: 2.21 ÷ 0.074 (Round to the nearest

Q187: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)2,002,000 B)2,011,000 C)2,000,000