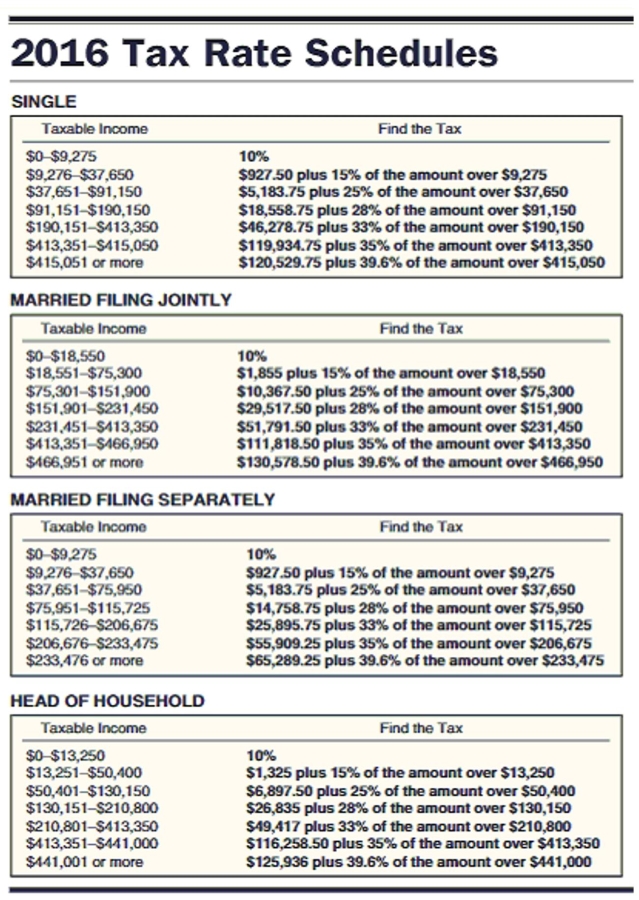

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Jennifer Binh is single and claims one exemption. Her salary last year was $95,949, and she had other income of $5,852 and interest income of $8,110. She has adjustment to income of $2,218 for an IRA contribution. Her itemized deductions are $4,996 in mortgage interest, $2,376 in state income tax, $1,642 in real estate taxes, and $782 in charitable contributions.

Definitions:

Negative Stereotype

A fixed, overgeneralized belief about a particular group or class of people that is unfavorable or harmful.

Out-Group

A social group toward which an individual feels a sense of competition or opposition, as opposed to an "in-group," which elicits feelings of loyalty and belonging.

Equal Pay Act

A labor law that prohibits gender-based wage discrimination, mandating equal pay for equal work performed by men and women.

Manufacturing Facilities

Places designed and equipped for the manufacturing of goods and products.

Q1: Stock: Hechinger<br>Current Price per Share: $16.68<br>Annual Net

Q2: 7, 14, 28, 49<br>A)49<br>B)392<br>C)147<br>D)196

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)0.2%, -140.0%, 0.5%,

Q31: $6,700, money earns 5% compounded annually, 8

Q50: If total expenses are $1,025 and the

Q53: 25.95 + 3.93 + 0.0208 + 0.691<br>A)22.6902<br>B)22.7318<br>C)30.5918<br>D)30.5502

Q56: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)$24,689.95 B)$56,689.95 C)$30,358.94

Q72: Cost: $19,000<br>Salvage: $1,900<br>Est. Life: 220,000 miles<br>A)$0.90<br>B)$0.09<br>C)$0.80<br>D)$0.08

Q150: If 4 books cost $3.97, then one

Q180: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)7,080 B)7,060 C)7,070