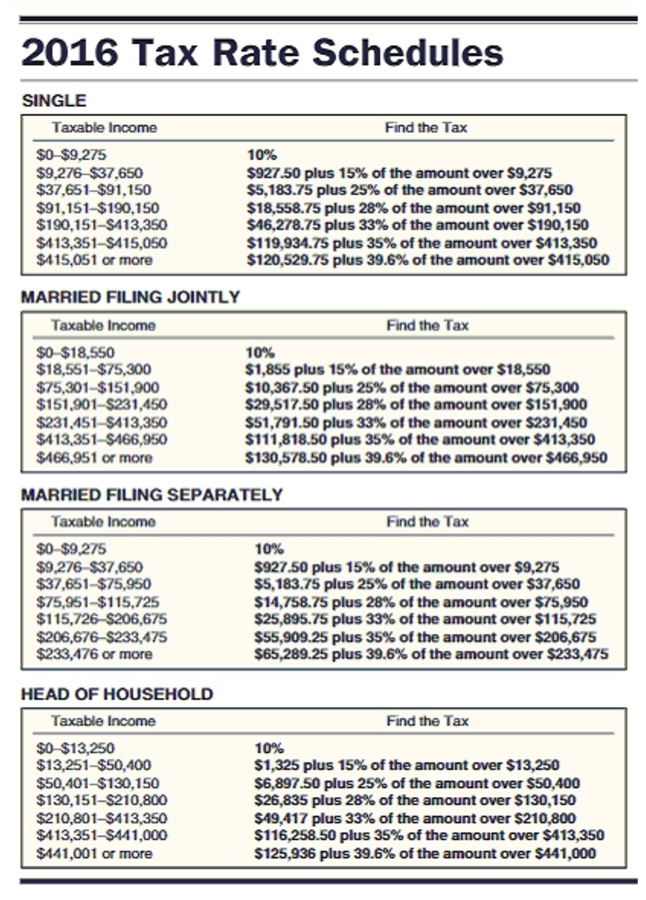

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Lilly Donaldson had wages of $31,706, other income of $2,962, dividends of $213, interest of $328, and a regular IRA contribution of $839 last year. She had deductions of $1,271 for state income tax, $1,440 for property tax, $1,460 in mortgage interest, and $713 in contributions. Donaldson claims three exemptions and files as head of household.

Definitions:

Medical Assistant

A healthcare professional who performs administrative and clinical tasks in support of doctors and other health professionals in medical offices, clinics, and hospitals.

OSHA

Known as the Occupational Safety and Health Administration, this agency of the U.S. government is in charge of promoting safety and health in the workplace.

Category I Tasks

Tasks or activities classified as highest priority or urgency, often indicating critical processes that require immediate attention or action in a given context.

Exposure

The state of being subject to possibly harmful conditions or substances, such as chemicals, noise, or unhealthy environments.

Q14: Recovery year: 5<br>Recovery period: 5-year<br>A)8.93%<br>B)12.49%<br>C)7.41%<br>D)11.52%

Q21: 9 years<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt="9 years A)

Q21: Bond: BLT<br>Last Price: 97.375<br>Number Purchased: 67<br>A)$66,933.00<br>B)$97,375.00<br>C)$65,241.25<br>D)$65,308.25

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q52: Wandell's Garden Shop had a cost of

Q53: Global Transport built a new building and

Q67: Annual interest paid<br>A)$575.00<br>B)$5.75<br>C)$57.50<br>D)$48.00

Q72: There were <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt="There were

Q88: $32,000, 8% compounded semiannually, 20 semiannual payments<br>A)$2,280.96<br>B)$2,354.56<br>C)$2,436.44<br>D)$878.89

Q106: Pelican Lumber Company owns a building with