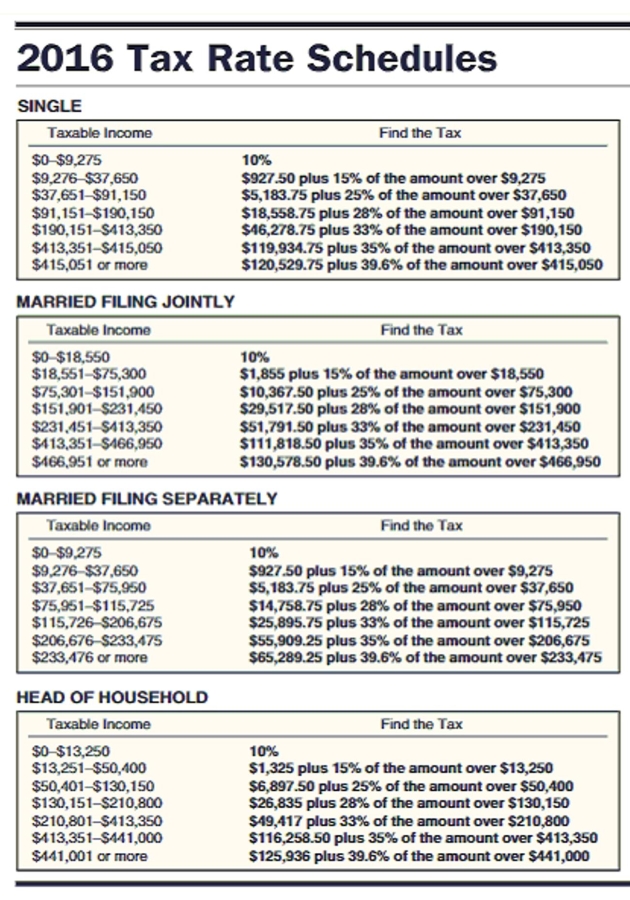

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-The Greenwoods had an adjusted gross income of $57,492 last year. They had deductions of $1,095 for state income tax, $4,205 for property tax, $5,320 in mortgage interest, and $2,261 in contributions. The Greenwoods claim four exemptions and file a joint return.

Definitions:

Asperger Syndrome

A developmental disorder affecting ability to effectively socialize and communicate, part of the autism spectrum.

Autism

A developmental disorder that affects communication and behavior, characterized by challenges with social interaction and by repetitive and restricted patterns of behavior.

Electroconvulsive Therapy

A psychiatric treatment where seizures are electrically induced in patients to provide relief from mental disorders.

Brief Psychotherapy

A short-term psychological treatment aimed at addressing specific issues and designed to produce insights or changes within a limited timeframe.

Q12: Amount: $2,200<br>Deposited: Jan 27<br>Withdrawn: Apr 5<br>A)$21.30<br>B)$21.94<br>C)$2,214.39<br>D)$14.39

Q14: What is the monthly payment on a

Q25: The Wellspring Company's fleet of trucks get

Q29: The following data give the color distribution

Q30: Marcus McGuire purchased a rental duplex (27.5-year

Q47: $9,000 at 8% compounded annually for 16

Q53: List the advantages and disadvantages of using

Q56: BT&T charges $0.36 for the first minute

Q93: A driver injures a bicycle rider. The

Q122: Tell what you would do if you