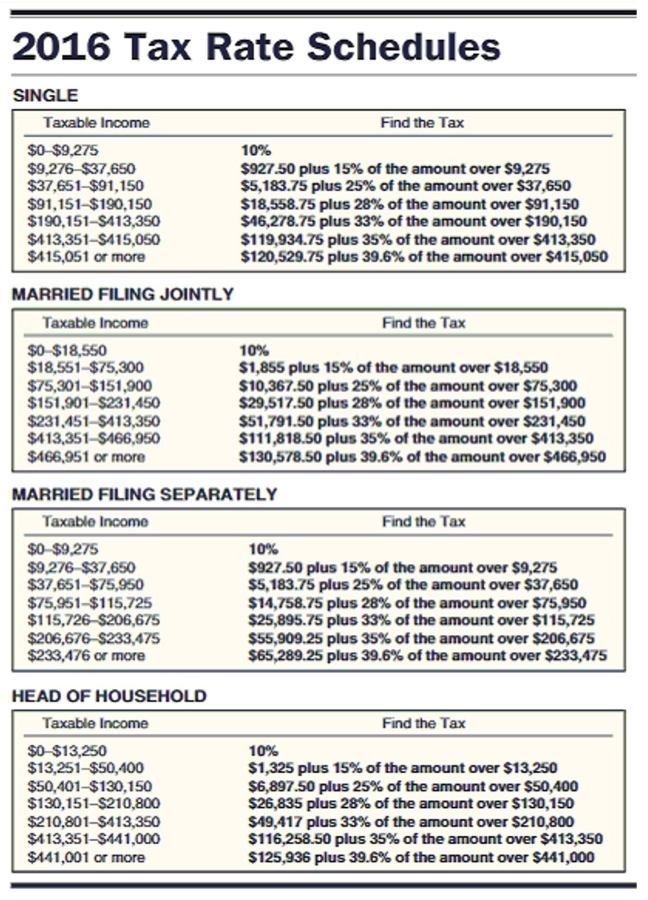

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Mark Collins had an adjusted gross income of $26,741 last year. He had deductions of $899 for state income tax, $555 for property tax, $2,824 in mortgage interest, and $221 in contributions. Collins claims one exemption and files as a single person.

Definitions:

Risk-free Rate

This is the theoretical rate of return of an investment with zero risk, typically represented by the yield on government securities.

Call Option

A financial agreement which permits the purchaser the option, though not the requirement, to purchase a specific asset like a stock, bond, commodity, or another type of asset at a predetermined price during a defined timeframe.

Exercise Price

The price at which the holder of an option can buy (call) or sell (put) the underlying security.

Protective Put

An investment strategy where an investor buys a put option for an asset they own to limit potential losses if the asset's price falls.

Q5: Fair market value: $189,000<br>Rate of assessment: 85%<br>A)$28,350<br>B)$160,650<br>C)$80,325<br>D)$1,606,500

Q12: 5,636 to the nearest ten<br>A)5,740<br>B)5,630<br>C)5,650<br>D)5,640

Q18: A person's youthful-operator factor is 2.35. The

Q29: Data-Serve Computer Services: fixed assets $59,000; mortgages

Q30: Amount financed: $315<br>Finance charge: $26<br>Number of monthly

Q61: If clothing is represented by 60° on

Q66: Cost: $425,000<br>Period: 10-year<br>A)$104,083<br>B)$60,733<br>C)$42,500<br>D)$76,500

Q77: The Robins Furniture Company had an insured

Q78: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)420,000 B)419,000 C)430,000

Q102: A new fax machine cost Miller Ltd.