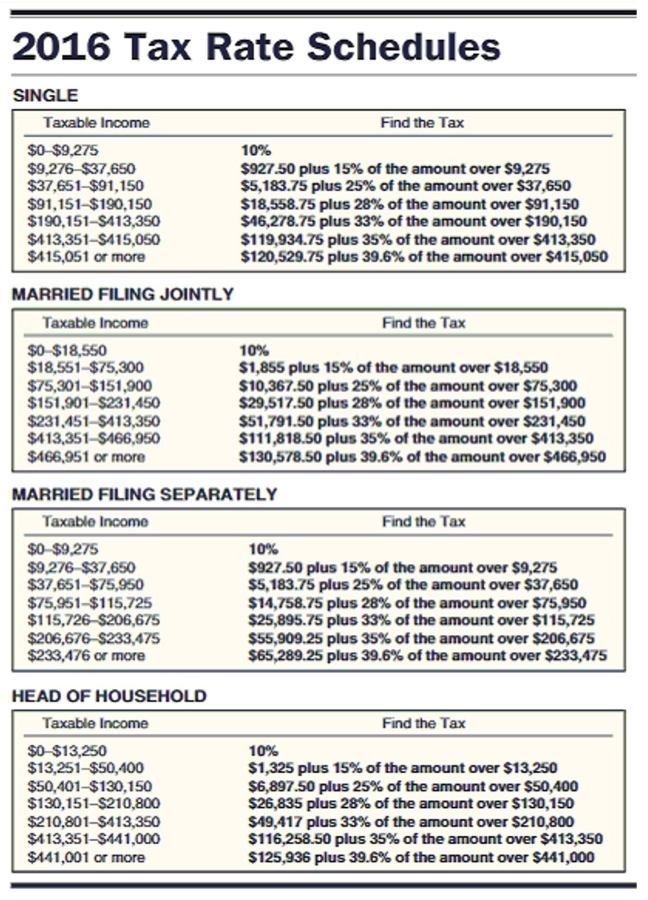

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Glenn and Natalie Dowling had combined wages and salaries of $69,117, other income of $5,258, dividend income of $317, and interest income of $664. They have adjustments to income of $2,435. Their itemized deductions are $9,180 in mortgage interest, $1,611 in state income tax, $846 in real estate taxes, and $1,193 in charitable contributions. The Dowlings filed a joint return and claimed four exemptions.

Definitions:

Devastating

Causing severe shock, distress, or destruction.

Pan-Indian Movement

A social and political movement among Indigenous peoples in the Americas aimed at promoting unity and common interests across tribal lines.

Tecumseh

A Native American leader of the Shawnee who played a major role in the early 19th century in resisting the expansion of the United States into native territory.

Tenskwatawa

Tenskwatawa, also known as the Prophet, was a Native American religious and political leader of the Shawnee tribe in the early 19th century, known for his opposition to U.S. expansion and his role in the pan-Indian alliance.

Q7: A taxpayer's property has a fair market

Q18: A laminated lab bench has <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg"

Q19: Total tax needed: $80,000<br>Total assessed value: $9,203,000<br>A)0.9%<br>B)1.1%<br>C)9.0%<br>D)0.8%

Q20: Finance charge: $397<br>Total number of payments: 28<br>Remaining

Q25: Dividend yield for ComputerSolns (CSL)<br>A)1.31%<br>B)0.7%<br>C)35.7%<br>D)70%

Q33: Price per bond<br>A)$1066.26<br>B)$1048.94<br>C)$1019.51<br>D)$106.63

Q63: An architecture firm purchases 5 new workstations

Q67: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)Estimate: 59, exact:

Q107: % of 9 gross is 0.02 gross.<br>A)2.2<br>B)450.0<br>C)22.2<br>D)0.2

Q194: 64,008 to the nearest thousand<br>A)64,100<br>B)65,000<br>C)64,010<br>D)64,000