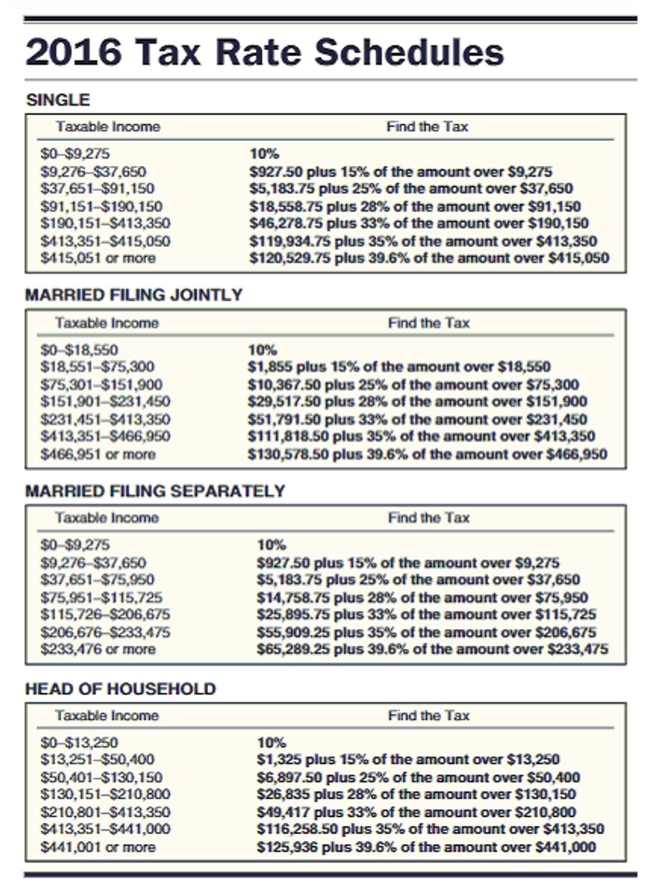

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Brian Moss had wages of $80,745, dividends of $374, interest of $684, and adjustments to income of $1,066 last year. He had deductions of $878 for state income tax, $452 for city income tax, $988 for property tax, $7,336 in mortgage interest, and $182 in contributions. He claims three exemptions and files as head of household.

Definitions:

Post-It

A small piece of paper with a re-adherable strip of glue on its back, made for temporarily attaching notes to documents and other surfaces.

Text Messages

Written electronic messages sent over a phone or computer network, typically consisting of short messages between two or more parties.

Noise

Unwanted sound, or a distraction that interferes with the communication process.

Deviation

A departure from a standard or norm, which can indicate variability in statistical data, processes, or behaviors.

Q34: Principal: $5,929 Rate: 5% Years: 14<br>A)$1,659.70<br>B)$3,438.41<br>C)$1,397.16<br>D)$7,588.71

Q40: John Lee's savings account has a balance

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q52: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" Finance rate is

Q54: A 49-year-old man deposits a total of

Q72: The Dixie Beer Company had an insured

Q73: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)25 B)

Q77: % of 47 clients is 362 clients.<br>A)1.3<br>B)77.0<br>C)770.2<br>D)0.1

Q98: If the list price is $29.24 and

Q105: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)$229.78 B)$21.21 C)$22.98