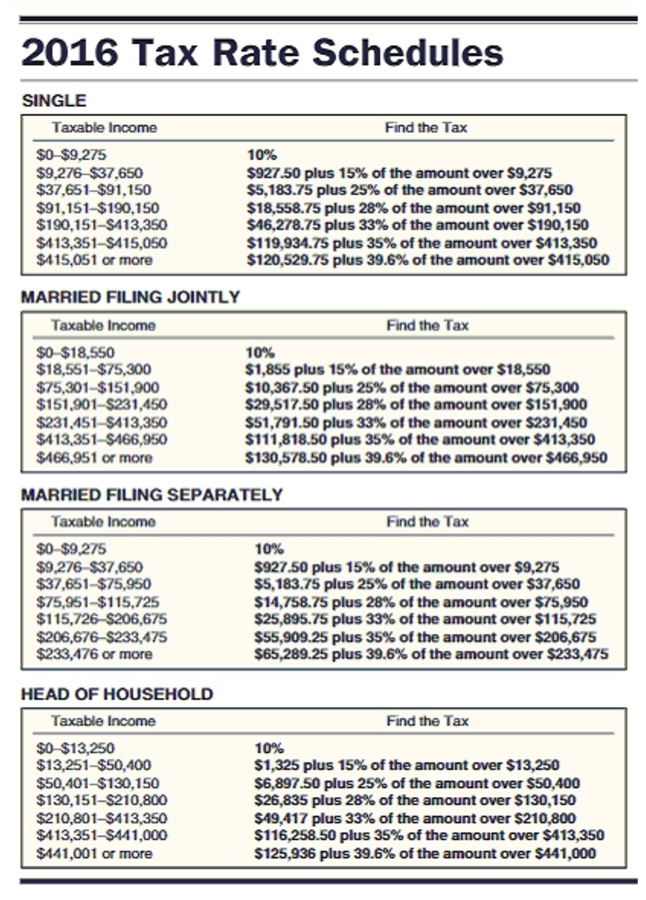

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Lilly Donaldson had wages of $31,706, other income of $2,962, dividends of $213, interest of $328, and a regular IRA contribution of $839 last year. She had deductions of $1,271 for state income tax, $1,440 for property tax, $1,460 in mortgage interest, and $713 in contributions. Donaldson claims three exemptions and files as head of household.

Definitions:

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)$2,011; $201.10 B)$8,866;

Q11: Explain in your own words why the

Q31: Rosie's Cleaning Service had a cost of

Q42: Steel Master Sales had a cost of

Q46: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)0.125 B)1.25 C)8

Q53: Fred Smith bought 39 shares of Acme

Q73: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)$281,532.68 B)$71,261.77 C)$292,955.69

Q85: Part: $6,804.00 Rate of increase: 35%<br>A)$6,804.00<br>B)$5,040.00<br>C)$9,185.40<br>D)$5,140.00

Q117: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)6 B)5 C)

Q138: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)584 R1 B)583