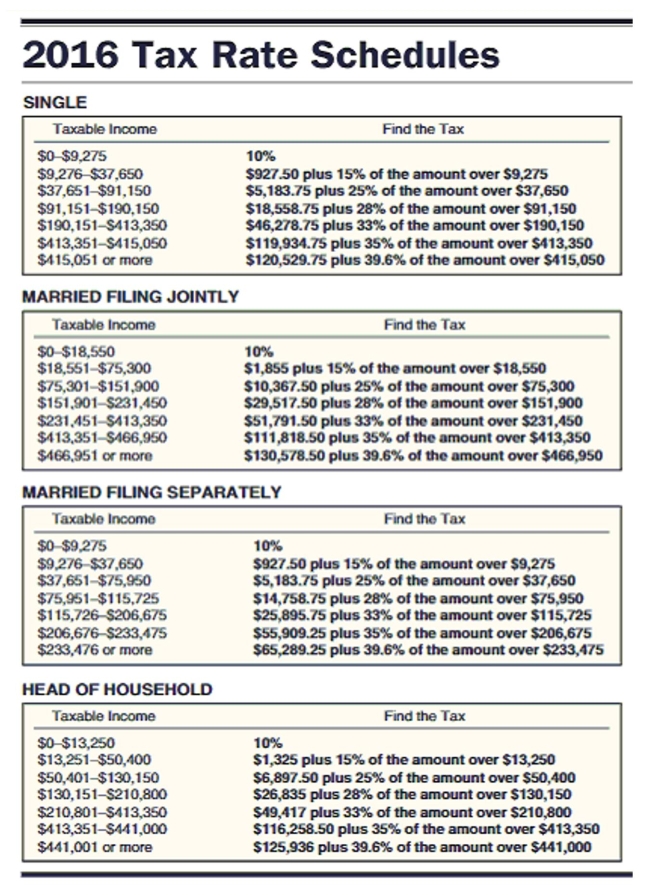

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-Megan Cortez had an adjusted gross income of $55,704 last year. She had deductions of $939 for state income tax, $764 for property tax, $3,890 in mortgage interest, and $1,294 in contributions. Cortez claims one exemption and files as a single person.

Definitions:

Productive

The state of achieving significant results, output, or progress, especially in terms of work or activities.

Impression Management

The practice of consciously making behavioral adjustments to project a desired image to others.

Inconsistent

Behavior or responses that show a lack of steadiness or uniformity, often leading to unpredictability.

Self-Promotion

The action of promoting oneself, one's abilities, or achievements, often to advance one's career or reputation.

Q12: Less than 30 years of age<br>A)22<br>B)18<br>C)29<br>D)36

Q42: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q42: Number of days spent working out in

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)1

Q77: If 361 candy bars cost $384.21, then

Q101: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q104: Carla's gross pay is $169 a week.

Q108: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q109: While shopping for a party, June bought

Q138: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)584 R1 B)583