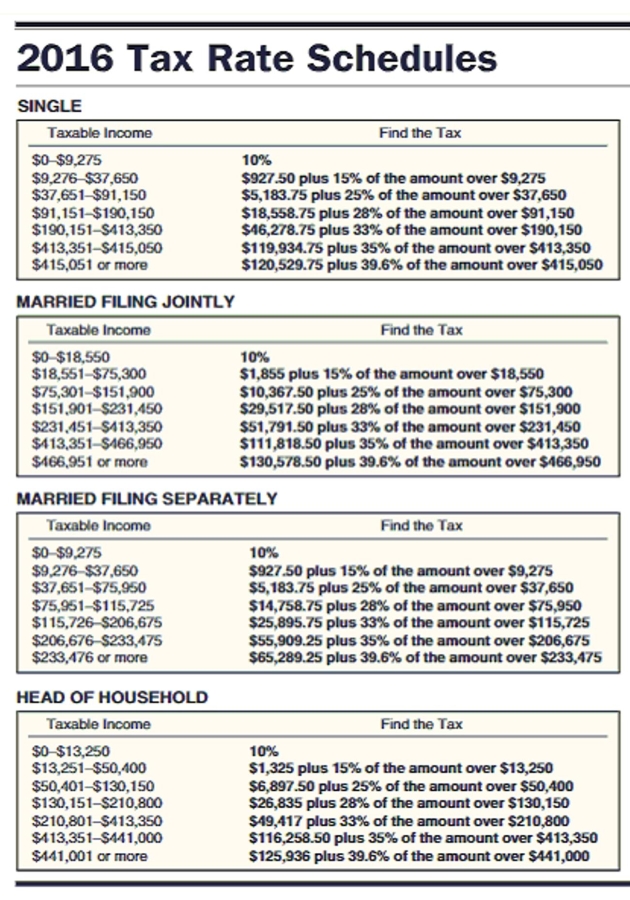

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 for married taxpayers filing separately, and $9300 for head of household and the tax rate schedule.

-The Greenwoods had an adjusted gross income of $57,492 last year. They had deductions of $1,095 for state income tax, $4,205 for property tax, $5,320 in mortgage interest, and $2,261 in contributions. The Greenwoods claim four exemptions and file a joint return.

Definitions:

OPEC

The Organization of Petroleum Exporting Countries, an intergovernmental organization of oil-producing countries that aims to manage the supply of oil to stabilize prices and ensure steady earnings.

Price Ceiling

A government-imposed maximum price that can be charged for a good or service, intended to protect consumers from high prices.

Market Demand

The aggregate of a good or service that each consumer in a market is eager and qualified to purchase at differing prices.

Binding

A situation where a restriction, such as a price ceiling or floor, actually affects the market outcome because it is set above or below the equilibrium price.

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)$114,668.57 B)$29,213.69 C)$106,673.93

Q12: Principal: $8200<br>Interest: 10.5%<br>Time (days): 220<br>Partial payment: $3000

Q26: Originally, an amateur was motivated by love,

Q32: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)4,122.2 B)4,121.21 C)4,121.1

Q39: Annual salaries: $21,096, $18,265, $30,962, $24,944 Round

Q61: John earns $11.51/hour. If he works 17

Q72: $7.49203<br>A)$7.492<br>B)$7.50<br>C)$7.48<br>D)$7.49

Q131: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)49 B)42 C)7

Q136: The stock market gained 18 points on

Q161: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)52.8 B)312.8 C)313.9