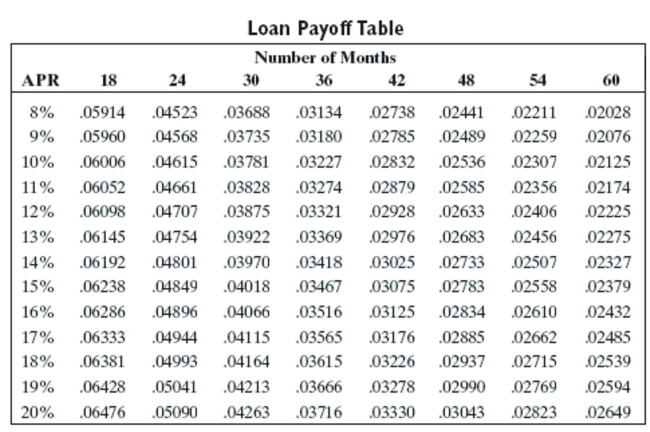

Use the loan payoff table to find the monthly payment and finance charge for the loan.

-Amount financed: $60,642

Number of months: 48

APR: 8%

Definitions:

Fiscal Year

A 12-month period used for accounting and reporting purposes, which may or may not align with the calendar year.

Payroll Taxes

Taxes that are withheld from employees’ salaries or wages by the employer and paid directly to the government. These can include income tax, social security, and Medicare taxes.

Federal Income Taxes

Federal income taxes are the taxes levied by the federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Maximum Amount

The highest allowable or attainable value, level, or quantity of something.

Q3: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" Finance rate is

Q3: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q14: If interest is compounded monthly at 8%

Q25: 110.48 ÷ 9.7 (Round to the nearest

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)

Q48: A manager of a local restaurant had

Q50: Explain why the approximate APR is not

Q53: List the advantages and disadvantages of using

Q67: Amount financed: $26,730<br>Number of months: 18<br>APR: 12%<br>A)$1,655.04,

Q74: Find the annual premium. Face Value: $45,000<br>Age