Solve the problem.

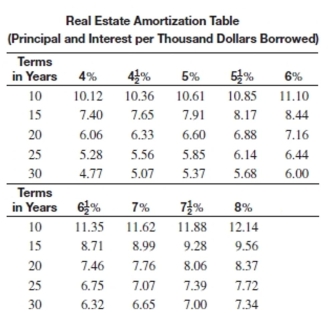

-The Montgomerys borrowed $88,000 at  for 30 years to purchase a house. Find the monthly payment and the sum of the principal and interest charges.

for 30 years to purchase a house. Find the monthly payment and the sum of the principal and interest charges.

Definitions:

Accelerated Cost Recovery

A method of depreciation used for tax purposes that allows for higher deductions in the early years of an asset's life.

Straight-Line Depreciation

Straight-Line Depreciation is a method where the cost of a tangible asset is reduced evenly over its useful life.

Deferred Tax Income Tax

A tax liability or asset that arises due to temporary differences between the financial reporting and tax bases of assets and liabilities.

Valuation Allowance

An accounting practice used to offset a deferred tax asset on the balance sheet if it is likely that some portion or all of the asset may not be realized.

Q14: A stereotype is a simplistic distortion of

Q23: The history of philosophy is no longer

Q28: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)$786.59 B)$78.66 C)$85.81

Q41: Depreciation per unit: $0.06<br>Units of production: 237,000<br>A)$14,220<br>B)$39,500<br>C)$1,422<br>D)$395,000

Q52: In one county, property is assessed at

Q70: Depreciation per unit: $0.36<br>Units of production: 23,000<br>A)$639<br>B)$8,280<br>C)$828<br>D)$6,389

Q72: The Dixie Beer Company had an insured

Q78: The Robinson Company had an insured fire

Q108: The Corner Cafe has a replacement cost

Q177: A company had net revenues of $8,500,945