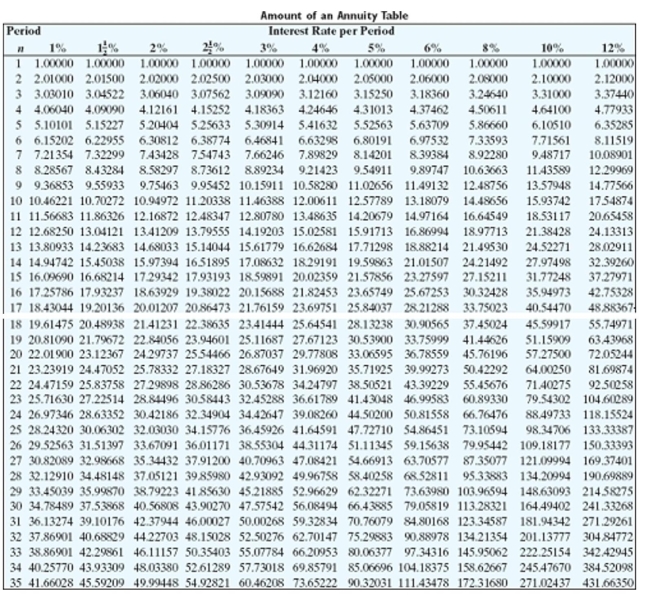

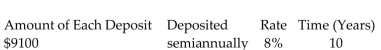

Find the amount of the ordinary annuity rounded to the nearest cent.

-

Definitions:

35%

This is often a reference to a specific tax rate, percentage rate of interest, or any other figure that is quantified at 35%.

Sole Shareholder

A single individual or entity that holds all the shares of a corporation, essentially owning the company outright.

FMV

Stands for Fair Market Value, which is the price that property would sell for on the open market.

Taxable Gain

The portion of profit or income derived from selling an asset that is subject to taxation.

Q4: $387.21<br>A)$387.31<br>B)$386<br>C)$387<br>D)$388

Q7: Principal: $3000<br>Interest: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt="Principal: $3000 Interest:

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)0.2%, -140.0%, 0.5%,

Q20: According to William G. McAdoo, who is

Q42: $50,000, 10% compounded annually, 26 annual payments<br>A)$5,508.40<br>B)$5,458.00<br>C)$5,412.88<br>D)$4,612.95

Q46: $800 at 6% compounded quarterly for 2

Q64: Payments of $3,300 made annually for 25

Q76: During one year 22 new employees started

Q82: Less than 20 years of age<br>A)18<br>B)29<br>C)9<br>D)36

Q116: Amount financed: $165<br>Down payment: $45<br>Cash price: $210<br>Number