Solve the application problem. If no interest rate is given, assume  % interest compounded daily. Round to the nearest

% interest compounded daily. Round to the nearest

cent.

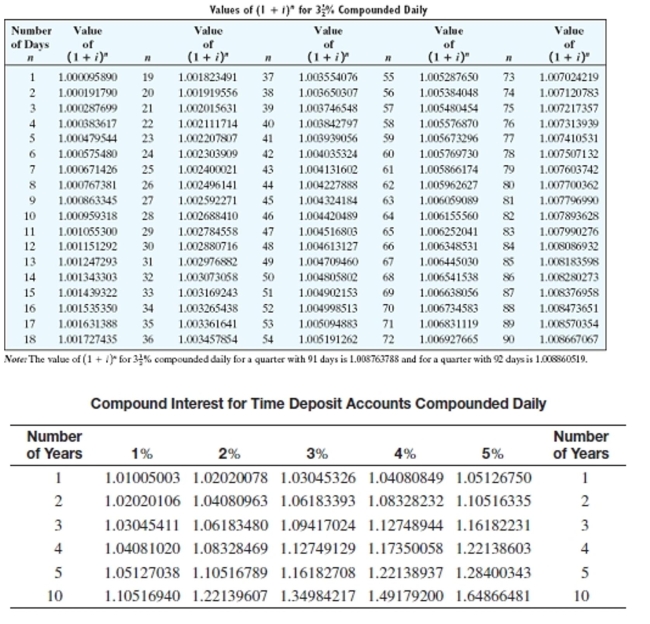

-A publishing company deposited $200,000 in a 2-year time deposit earning 6% compounded daily with a Chicago bank as partial collateral for a loan. Find the compound amount and the interest earned.

Definitions:

Price Elasticity

A quantification of the demand elasticity for a good relative to its price alterations.

Price Elasticity

An indicator of the sensitivity of the demand for a product to fluctuations in its price, represented by the percentage change.

Quantity Demanded

The specific amount of a product that buyers are willing to purchase at a given price, holding all other factors constant.

Absolute Value

A mathematical function that describes the distance of a number on the number line from zero, disregarding its direction; always a non-negative value.

Q1: Who was perhaps the greatest Sophist?<br>A) Aristotle<br>B)

Q11: What is the monthly payment on a

Q32: Who challenged Socrates to a beauty contest?<br>A)

Q38: Principal: $167<br>Interest: 12%<br>Time (days): 30<br>Partial payment: $50

Q42: Assessed Tax rate valuation :: $82,$7.00400 per

Q45: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)$100,716.67

Q63: What alone exists, according to Democritus?<br>A) Sweetness

Q102: A new fax machine cost Miller Ltd.

Q102: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8285/.jpg" alt=" A)14 R40 B)15

Q200: The original price on a shirt is