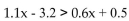

Solve.

-

Definitions:

Paid Executives

High-level officers or managers within a company who are compensated with a substantial salary, bonuses, and often, benefits and stock options.

Labour Costs

Expenses related to compensating employees for their work, including wages, salaries, and benefits.

Profit Margins

A measure of profitability calculated as net income divided by revenue, indicating the percentage of each dollar of revenue that results in profit.

Financial Constraint

Limitations on the availability or use of financial resources, which can impact decision-making and strategy implementation.

Q1: An airplane travels 800 miles against the

Q5: Use the data in the following table

Q7: Write an article on a blog to

Q7: Describe a company's grapevine. <br>For the same

Q22: Create a project plan. <br>Working in groups

Q24: What could be improved in this message

Q68: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8306/.jpg" alt=" A)(1, 1) B)(3,

Q79: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8306/.jpg" alt="Find A)-226

Q82: 37(x - 148)= 74<br>A)146<br>B)74<br>C)150<br>D)148

Q177: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8306/.jpg" alt=" A)