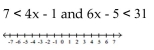

Solve and graph.

-

Definitions:

Investment Allowance

Investment allowance is a tax incentive that allows businesses to deduct a certain percentage of their investment in assets from their taxable income.

Operating Revenue

Income generated from a company's core business activities, excluding income from investments or secondary sources.

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary depending on income level, type of business, or legal jurisdiction.

Tax Effect

The impact of tax laws on the financial performance of a business, influencing its net income and cash flow.

Q1: Which of the following characteristics of a

Q3: Practice writing different types of sentences. <br>Write

Q5: You want to assess the effects of

Q8: Discuss ethical dilemmas. <br>Working in small groups

Q56: 4(4x - 1)= 16<br>A) <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8306/.jpg" alt="4(4x

Q71: x + y = -12 2x -

Q72: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8306/.jpg" alt=" A)

Q98: (Who/Whom) will you ask to participate in

Q105: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8306/.jpg" alt=" A)

Q121: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8306/.jpg" alt=" A)