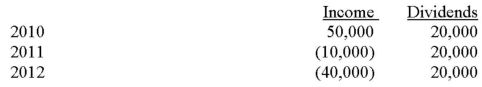

Dragon Corporation acquired a 7% interest in the outstanding shares of Slayer Inc. on January 1, 2010 at a cost of $200,000. Dragon Corporation was a private company and reported in compliance with the Accounting Standards for Private Enterprises and accounted for Slayer Inc., whose shares were not publicly traded, using the cost method. Slayer reported net income and made dividend payments to its shareholders at noted below. On December 31, 2012 Slayer declared bankruptcy as a result of a series of losses as noted.  a) Prepare the journal entries that Dragon would make in each year. b) Prepare the general ledger account for Dragon's investment in Slayer.

a) Prepare the journal entries that Dragon would make in each year. b) Prepare the general ledger account for Dragon's investment in Slayer.

Definitions:

Average Total Assets

The mean value of all assets owned by a company over a specific time period, used in financial analysis to measure efficiency and productivity.

Q6: Which of the following was NOT a

Q32: A confidence interval was used to

Q39: A random sample of size

Q53: Which of the following provides the best

Q62: If the joint production costs are allocated

Q68: Soprano Corporation allocates administrative costs on the

Q78: The breakdown of costs by departments is

Q104: An industrial psychologist conducted an experiment

Q109: Many people think that a national

Q115: You are performing a study about