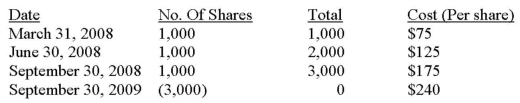

Telnor Corporation (whose year end is December 31 of each year) has made a series of investments in Pineapple Corp., one of their major customers. The management of Telnor has been impressed by the products produced and sold by Pineapple and their market success. These investments are only going to be held for a short period of time. The market price of Pineapple stock on December 31, 2008 and 2009 was $200 and $250 respectively per share. Dividends of $1.00 per share were declared and paid on December 31 of each year. The following are the purchases and sales that Telnor entered into in 2008 and 2009:  Assume that Telnor accounts for its investment in Pineapple Corp. at fair value through other comprehensive income a) Prepare the journal entries to record the transactions in 2008 and 2009 with respect to Telnor's investment in Pineapple. b) How would Telnor disclose the investment in Pineapple on its balance sheet?

Assume that Telnor accounts for its investment in Pineapple Corp. at fair value through other comprehensive income a) Prepare the journal entries to record the transactions in 2008 and 2009 with respect to Telnor's investment in Pineapple. b) How would Telnor disclose the investment in Pineapple on its balance sheet?

Definitions:

Earnings per Share

A financial performance metric that calculates the portion of a company's profit allocated to each outstanding share of common stock, indicating the company's profitability.

Equity Multiplier

A financial ratio indicating the portion of a company’s assets that are financed by stockholder's equity.

Debt-to-equity Ratio

An indicator of the distribution between shareholders' equity and borrowed funds in financing a company's assets.

Times Interest Earned Ratio

A financial metric that measures a company's ability to pay its interest expenses with its before-interest earnings.

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)

Q10: The Sarbanes-Oxley Act established the:<br>A) Securities and

Q12: Hot Inc. owns 60% of Cold Inc,

Q13: Which of the following statements is correct?<br>A)

Q15: Non-Controlling Interest is presented under the Liabilities

Q16: Under section 404 of the Sarbanes-Oxley Act,

Q37: The following are selected transactions for HELP-ON-US,

Q40: A physical fitness association is including the

Q51: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q101: The board of examiners that administers the