Select the correct Answer for each question.

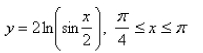

-Find the length of the curve.

Definitions:

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the impact of an additional dollar of income on the amount of taxes owed.

Taxable Income

The amount of income that is subject to taxes, after all deductions and exemptions have been factored in.

After-Tax Income

The amount of income left after all taxes have been deducted.

Progressive Tax

A tax system where the tax rate increases as the taxable amount increases, typically applied to income tax to ensure those with higher earnings pay a higher rate of tax relative to their income.

Q2: Evaluate the integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Evaluate the

Q7: Announce a new initiative using clear, simple

Q10: Respond to another student's review. <br>Give the

Q11: After 10 years, 1,000 shares of stock

Q17: Find the average value of the function

Q24: What delivery techniques will you use to

Q31: Find the solution of the initial-value problem

Q40: Find the integral using an appropriate trigonometric

Q59: Find the average value of the function

Q87: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Let be