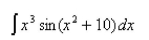

Use a table of integrals to evaluate the integral.

Definitions:

Sigmund Freud

An Austrian neurologist and the founder of psychoanalysis, a clinical method for treating psychopathology through dialogue between a patient and a psychoanalyst.

Stuttering

A speech disorder characterized by repeated or prolonged sounds, syllables, or words, disrupting the normal flow of speech.

Transference

In psychoanalysis, the patient’s transfer to the analyst of emotions linked with other relationships (such as love or hatred for a parent).

Psychological Conflicts

Inner struggles resulting from the clash of opposing needs, desires, or emotions.

Q10: Find the volume of the solid generated

Q12: Evaluate the integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Evaluate the

Q15: Evaluate the limit.Select the correct Answer <img

Q23: Find the area of the surface obtained

Q30: The velocity graph of a braking car

Q44: Find the centroid of the region bounded

Q77: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="If is

Q119: Express the sum as a single integral

Q143: Find an expression for the area under

Q149: Find the area of the shaded region.