Select the correct Answer for each question.

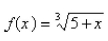

-Use the power series for  to estimate

to estimate  correct to four decimal places.

correct to four decimal places.

Definitions:

AGI

Adjusted Gross Income, which is the total gross income minus specific deductions allowable by the IRS, forming the basis for calculating taxable income.

Maximum Contribution

Maximum Contribution refers to the highest amount that an individual or entity can contribute to a retirement plan or investment vehicle in a given year.

Employer-Sponsored Plans

Retirement or health benefit plans offered to employees by their employer, including 401(k) and pension plans.

Coverdell Education

A savings account designed to help families pay for education expenses, offering tax-free growth and withdrawals when for qualified education costs.

Q5: Express the numb <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Express the

Q7: Use the Alternating Series Estimation Theorem or

Q18: Evaluate the limit. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Evaluate the

Q38: Find the midpoint of the line segment

Q50: Determine whether y is a function of

Q58: Use differentials to estimate the amount of

Q59: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt=" for the function

Q83: Find the center and the radius of

Q101: Find the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8680/.jpg" alt="Find the

Q127: Find the scalar tangential and normal components