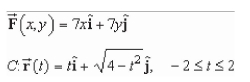

Evaluate  where C is represented by

where C is represented by

Definitions:

Deferred Tax Asset

A tax reduction or benefit that arises due to temporary differences between the book value and tax value of assets and liabilities, which can be used to offset future tax liabilities.

Income Taxes Payable

The amount of income tax a company owes to the government but has not yet paid, usually accumulated over a financial period.

Income Tax Expense

The amount of money a company owes in taxes based on its taxable income.

Long-term Debt

Debt obligations with a maturity of more than one year, utilized to finance a company's operations or expansions over a longer period.

Q8: Find all values of x for which

Q14: Find the particular solution of the linear

Q18: Suppose that the population (in millions) of

Q21: Find the sum of the convergent series.

Q52: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" How many are

Q89: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)

Q96: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)

Q212: 9, 11, 14,18, ...<br>A)Geometric; r = 9<br>B)Arithmetic;

Q213: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)