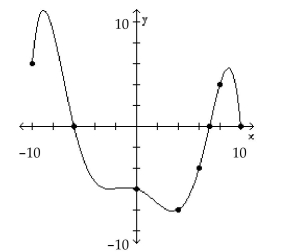

The graph of a function f is given. Use the graph to answer the question.

-What is the y-intercept?

Definitions:

Beta

A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole, where a beta greater than one indicates higher than market volatility and less than one indicates lower.

Security Market Line

The Security Market Line graphically represents the expected return of assets as a function of their systematic, non-diversifiable risk.

Risk-Adjusted Rate

A rate of return that has been adjusted to take into account the risk or volatility of the investment, providing a more accurate measure of its potential reward.

Risk Aversion

A preference to avoid uncertainty, characterized by investors' tendencies to prefer safer investments over more risky ones.

Q6: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)

Q15: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)No; x is

Q18: Is f(3)positive or negative? <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt="Is

Q36: Find (f + g)(-4)when f(x)= x -

Q91: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)function domain: {5,

Q140: 9(8 - 9i)<br>A)72 - 81i<br>B)72 + 81i<br>C)72i

Q156: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)

Q176: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)

Q179: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)

Q181: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8253/.jpg" alt=" A)