SCENARIO 5-7 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-7

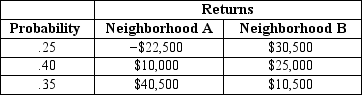

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition.The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-7,if you can invest 70% of your money on the house in neighborhood A and the remaining on the house in neighborhood B,what is the portfolio expected return of your investment?

Definitions:

Salvage Value

The estimated residual value of an asset at the end of its useful life, important for depreciation calculations.

Internal Rate Of Return (IRR)

The discount rate that makes the NPV of an investment zero.

Straight-Line Depreciation

A technique for distributing the expense of a physical asset evenly across its lifespan in identical yearly payments.

Minimum Rate Of Return

The lowest acceptable return on investment, beyond which investment options are not considered.

Q11: Referring to Scenario 3-12, for a laptop

Q26: Referring to Scenario 5-7, if you can

Q41: When A and B are mutually exclusive,

Q60: The mean score of all pro golfers

Q63: Theoretically, the mean, median, and the mode

Q66: If P (A or B)= 1.0, then

Q94: The true length of boards cut at

Q113: Referring to Scenario 6-1, for a randomly

Q164: Referring to Scenario 4-11, if an adult

Q171: Referring to Scenario 5-5, what is the