SCENARIO 5-7 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-7

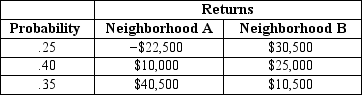

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition.The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-7,if your investment preference is to maximize your expected return while exposing yourself to the minimal amount of risk,will you choose a portfolio that will consist of 10%,30%,50%,70%,or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Definitions:

Testamentary Trust

A trust that is created by a will and comes into effect upon the death of the person who created the will, distributing assets according to the will's provisions.

Inter Vivos Trust

A trust created during the lifetime of the grantor, allowing for the management and distribution of assets before death.

Spendthrift Trust

A legal arrangement that restricts the beneficiary's ability to access the trust capital directly, thus protecting the trust assets from creditors.

Income-Producing

Capable of generating income, typically through investment or business operations.

Q20: According to the empirical rule, if the

Q58: An economist is interested in studying the

Q62: As a rule, a value is considered

Q72: Referring to Scenario 6-2, for a given

Q74: Which descriptive summary measures are resistant statistics?<br>A)The

Q77: A prison official wants to estimate the

Q116: A national trend predicts that women will

Q121: Suppose Z has a standard normal distribution

Q149: If two events are mutually exclusive and

Q160: Referring to Scenario 6-2, the probability is